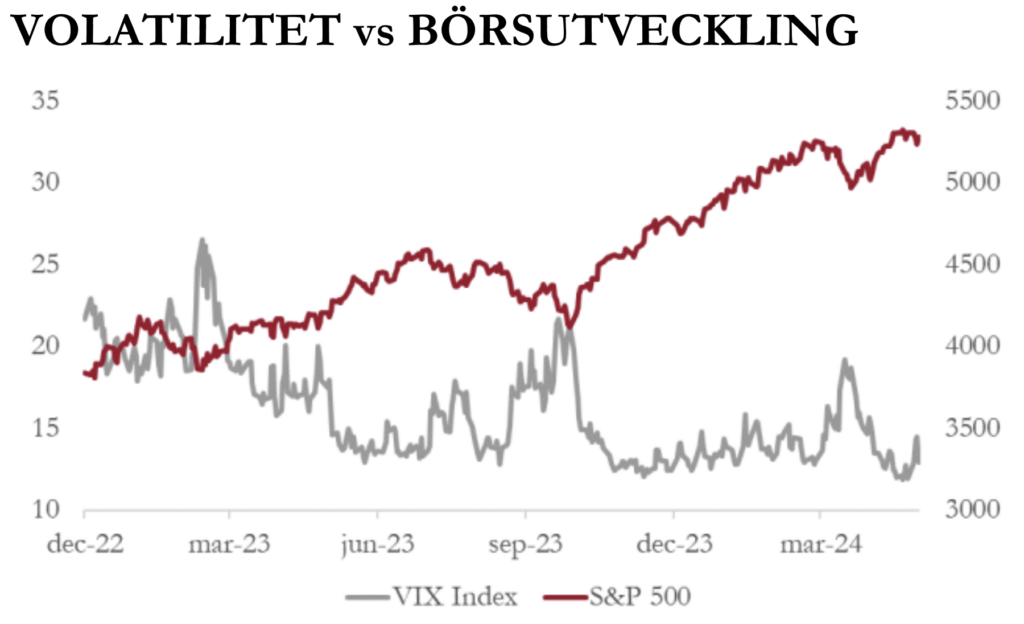

Volatility in the markets continues to fall, creating new opportunities for active fund managers. For Crescit, this means better conditions for creating a strong risk-adjusted return, something that the fund's latest results clearly show.

May 2024 was marked by a continued decline in volatility, a development that historically favors stock market gains. For Crescit, this has meant a favorable environment for the fund's derivative strategies, where the opportunity to buy protection at lower prices has increased.

During the month, we saw some decline in the value of existing portfolio hedges, but the long-term potential for strong risk-adjusted returns remains. This is part of Crescit's overall strategy to manage risks while exploiting the market's long-term growth opportunities.

For investors seeking stability in an otherwise volatile market, Crescit's management strategy offers a balanced approach focused on minimizing downside and maximizing returns.