Protect is an innovative global equity fund that offers investors exposure to the global stock market with a unique risk management strategy. Unlike traditional global equity funds, which directly invest in stocks from different countries, Protect uses a sophisticated method based on derivatives to create its global exposure.

The fund's allocation is done exclusively through the use of derivative instruments. This gives the fund a high degree of both flexibility and efficiency in management. A central part of Protect's strategy is its protection program, which is traded daily and systematically. This continuous and transaction-intensive approach ensures that the fund's risk profile is optimized based on current market conditions.

For Protect's strategy to be effective, two key conditions are required: low transaction costs and good liquidity in the underlying options markets. These factors are crucial for the fund to be able to carry out its daily adjustments without being negatively affected by high costs or limited trading capacity.

A challenge for the strategy is that some global equity indices lack sufficiently liquid options contracts. Indices with high volatility are also generally unsuitable for the fund's strategy, as they can lead to higher costs and thus increased risk of an underperforming sub-strategy.

To address this issue, a tailor-made basket of four carefully selected indices has been constructed. These indices have been selected based on the premise of their liquidity and price transparency in the respective options markets. The basket is then optimized to create a high historical correlation with the global equity market.

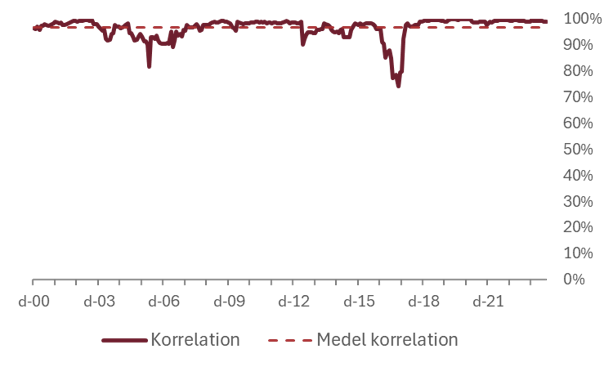

The goal of this index basket is to reflect the global stock market and its development as closely as possible. There is no ambition to create added value by overweighting or underweighting geographical markets in the basket. The average correlation has been around 96% and is stable, with a few exceptions close to 100%.

By using this specially designed index basket, Protect can achieve its objective of offering global equity exposure while taking advantage of liquid options markets for its risk management strategy.

This innovative approach allows Protect to combine the benefits of global diversification and sophisticated risk management, creating a unique investment opportunity for investors seeking exposure to the global equity market with built-in downside protection.