The Protect Fund's robust risk management strategy

Our sophisticated risk management model uses the Black-Scholes formula to value all derivatives in the fund. By locking in all parameters except the stock index, we are able to create a theoretical “worst case” scenario for the fund. This conservative approach is particularly relevant as the fund is long volatility, which has historically increased during stressed market conditions and would then benefit the fund’s performance.

Stress tests and protection mechanisms:

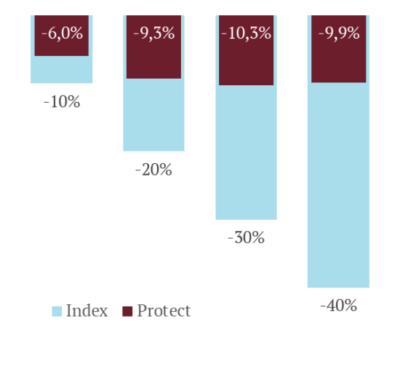

- Market stress: We analyze the fund's expected behavior during market declines of 10%, 20%, 30% and 40%.

- Limited decline: In the event of a momentary drop of -20%, Protect is only expected to lose -9.3% in value.

- Built-in protection: After the -20% drop, no significant further decline is expected for the fund.

Explanation: In the event of a -20% market decline, a large portion of the fund's put options are activated, effectively protecting the fund's underlying market exposures.

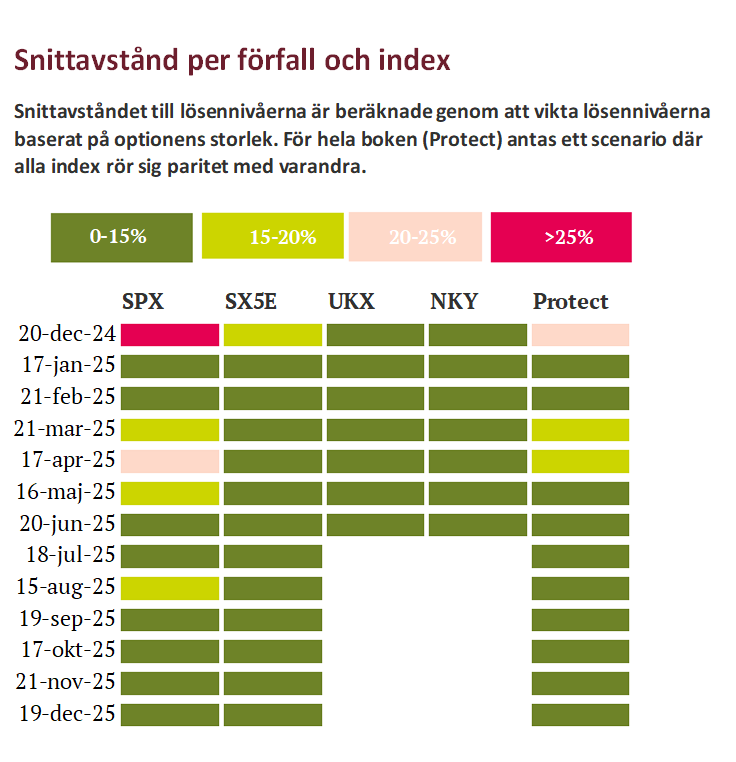

The majority of our protections are within 0-10% of the strike price (dark green area in the illustration below). This correlates well with our stress test, which shows that the fund's decline in value slows down significantly in the event of a -20% market decline.

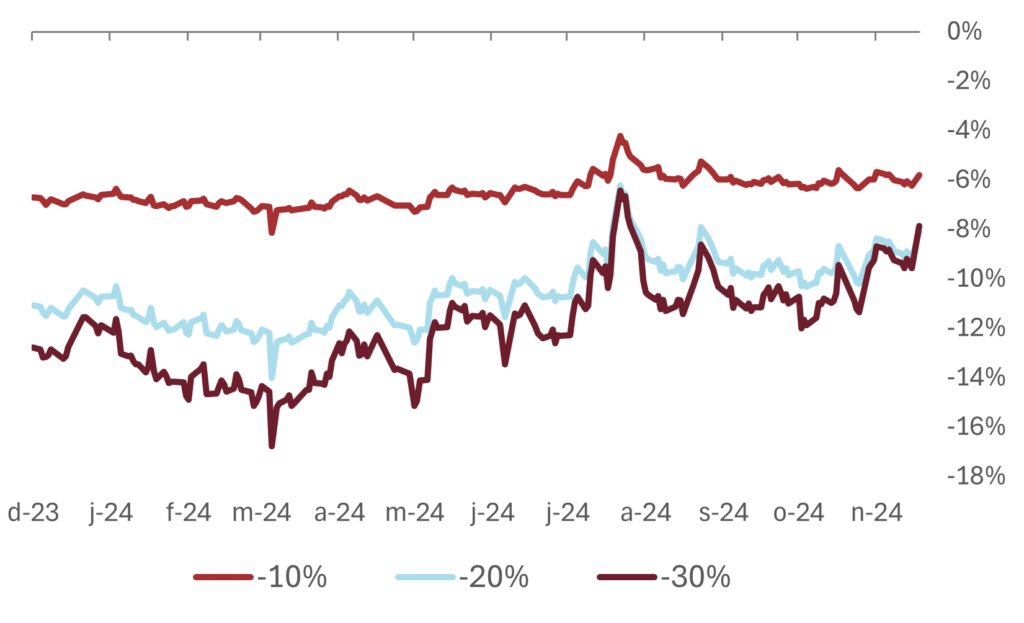

To put today's risks in historical context, current stress tests can be compared to historical stresses (which are saved daily in Crescit's databases). Today's levels are above the average of the past 12 months, while being clearly lower than what was the case in connection with the JPY carry unwind in early August.