Crescits' return was in line with expectations for October. After a weak closing, the global stock market index summed up to a decline that was slightly worse than the rise in September (total -0.39 %). Crescit has created a stable positive return during the period thanks to our exploitation of market movements (+0.42 %). Derivatives management provides the opportunity to create added value despite fairly small net movements. At the same time, the fixed income book has developed well and during the summer/autumn we have reduced exposure to credits against the backdrop of unusually low credit spreads.

Crescit has in recent years actively shifted our allocation from equity derivatives to fixed income assets and then back to equity derivatives. Our allocation follows the opportunities in each market as we perceive them and the opportunities we see in the pricing of derivatives. The overall risk in the fund remains quite low in the face of a potentially chaotic US presidential election. After the election, we see good opportunities for a positive end to the year as uncertainty decreases.

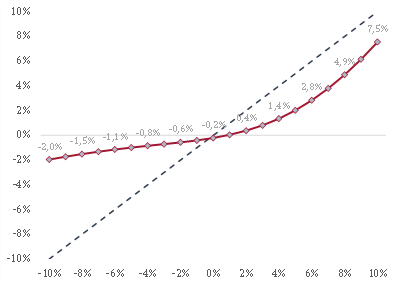

The stress test shows the fund's expected performance in the event of a parallel shift in the stock market index and reflects our wait-and-see view of the market and the goal of creating a competitive risk-adjusted return for our unitholders over time.