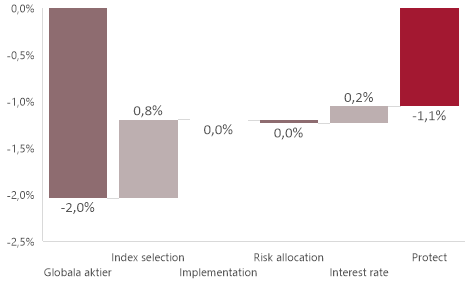

Protect developed strongly during the month and despite an indicative sensitivity of 70 %, the decline was only 53 % of the movement for global stocks. The B class thus fell by -1.06 % while the C class got a big boost from the weak Swedish krona and rose +4.43 %

Although currency should be a zero-sum game in the long term, a global equity exposure like Protect benefits from the positive correlation of the krona to risk sentiment. The US dollar tends to rise in times of uncertainty, creating an additional layer of protection for Swedish investors in Protect C.

Protect's systematic derivatives management continued to deliver as expected and in the middle of the month we took profits on the positions the fund took after the fall in September to participate in an upward rebound.

Ahead of a potentially volatile period, we have adjusted the portfolio protections to balance the risk in the fund. Thanks to Protect not relying on correlation-based protections but actual portfolio protections, the fund was able to deliver clear added value in the falling market. (Additional correlation protection can be selected through the C class, which benefits from the dollar exposure as described above.)