November began with the election that we have been waiting for and looking forward to all year. The outcome was, in our opinion, relatively expected given how both betting markets and financial markets acted in the run-up to the election. Now, large flows are being created and moved as investors adjust their portfolios to the new reality, creating both opportunities and difficulties.

There is a difference between pricing and forecasting

In the run-up to the election, we saw a lot of market volatility. US stocks rose sharply in line with market interest rates and expected volatility. This was generally interpreted as a sign that Trump was headed for victory and the market priced in his upcoming policies and punitive tariffs. Some interesting reflections in hindsight are:

- Despite the sharp adjustment from the market, the movement was accentuated by the election outcome – there was thus more to be gained than what was priced in in advance.

- If the market adjusted so much before and after the outcome, what would it have meant for financial markets if Harris had won? Lower interest rates and significantly lower stock prices seem likely?

- At the time of writing, the 10-year yield has fallen to lower levels than it was before the election, the dollar has given back about half of its rise, but broad stock market indices are trading at further new highs – perhaps this is an indication of what is to come…?

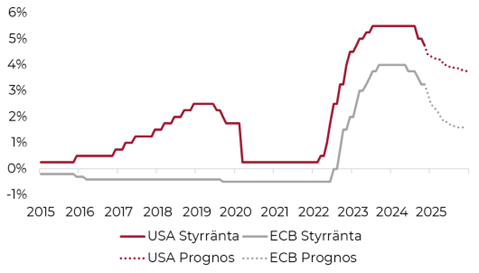

Diverging interest rate paths

As the new year approaches, there is, as always, great uncertainty about what the future will bring. An interesting development that has been observed in recent weeks is that monetary policy around the world appears to be starting to diverge again. The strong American economy appears to be putting a damper on the Federal Reserve's interest rate cut plans, while the weak German manufacturing industry is providing an excuse for the ECB to, if anything, cut rates a little more than they have previously communicated. The Riksbank, for its part, is struggling with a weak krona and a possible rebound in inflation.