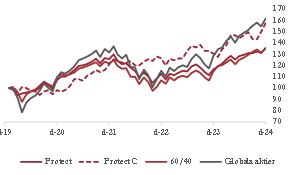

Protect continued to perform well during December with clear relative excess returns against global equities and at significantly lower risk. The derivatives program delivers very good returns at 30-40% lower risk than equities and 2024 as a whole was a very good year for the fund. For the full year, the return totaled 12.18 %, while the C class, helped by a weakened Swedish krona, rose by a whopping 23.05 % and Global shares rose by approximately 17%.

During the month we only made small active adjustments to the systematic strategy. Heading into the year-end, Protect has a relatively high sensitivity and thanks to the low expected volatility, 2025 looks set to be another good year for Protect.

The currency exposure in the C class should be a zero-sum game in the long term, but as long as the world is characterized by unusually high uncertainty, the fund benefits from the krona being characterized by the willingness to risk internationally. The US dollar tends to rise in times of crisis, which creates an additional layer of protection for Swedish investors.

With the uncertainty of the presidential election behind us and an incoming government focused on reducing regulations and increasing growth, it looks like we are facing a long period of favorable climate for Protect.