Crescit performed slightly better than expected in December. The relatively small net movements offset each other in a month that started strong but ended weakly. Heading into the year-end, Crescit has a relatively balanced exposure where we have started to establish a selective credit book again after being underweighted towards corporate credit during the year.

We see falling interest rates, reduced regulatory burdens and potentially higher growth as drivers in the short term. As long as Europe is suffering from choppy growth and a reluctance to political reform, we unfortunately do not see a strong situation for the stock market, although in the short term there may be some potential for a rebound. We intend to continue to create a strong risk-adjusted return without increasing risk unnecessarily.

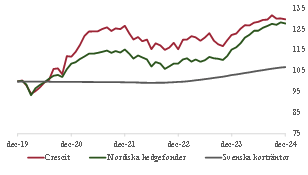

2024 was a good year for Crescit, delivering a stable return with very low risk. As a complement to traditional assets, we are pleased with our return of 5.95 % in a situation where the Swedish stock market (OMSX30) delivered only in parity with the risk-free interest rate of +3.6 % for the full year.