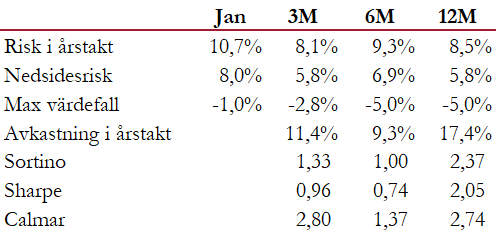

Protect performed well during January with a strong absolute return of 2.3% at a significantly lower risk than stocks.

During the month we actively worked on the exposure to Europe to avoid being limited by the strong underlying movement. The last trading day in 2024 was 30/1, which means that the fund's performance is slightly lagging compared to other stock markets. The equity exposure managed to realize 72% of global stock movement during the month, which is strong as underlying markets that rose sharply in a short time usually disadvantage the fund's performance.

The currency exposure in the C class should be a zero-sum game in the long term, but as long as the world is characterized by unusually high uncertainty, the fund benefits from the krona being characterized by the willingness to risk internationally. The US dollar tends to rise in times of crisis, which creates an additional layer of protection for Swedish investors.

During the month, Inveztly released its analysis of the full year 2024, where Protect came out as the 5th best fund, which is very pleasing.