Crescit offers two funds with different risk profiles and return expectations, all based on the same basic philosophy. Derivatives are central to creating a better return expectation compared to direct investments in stock indexes, where the size and type of positions are adjusted to the fund's risk appetite. The first fund, Crescit (the original fund), has the lowest risk and the least historical fluctuations. Crescit Protect derives returns from the global stock market and has a higher risk, but continuously protects against major stock market falls. Through these options, investors can choose the level of risk and potential return that best suits their needs.

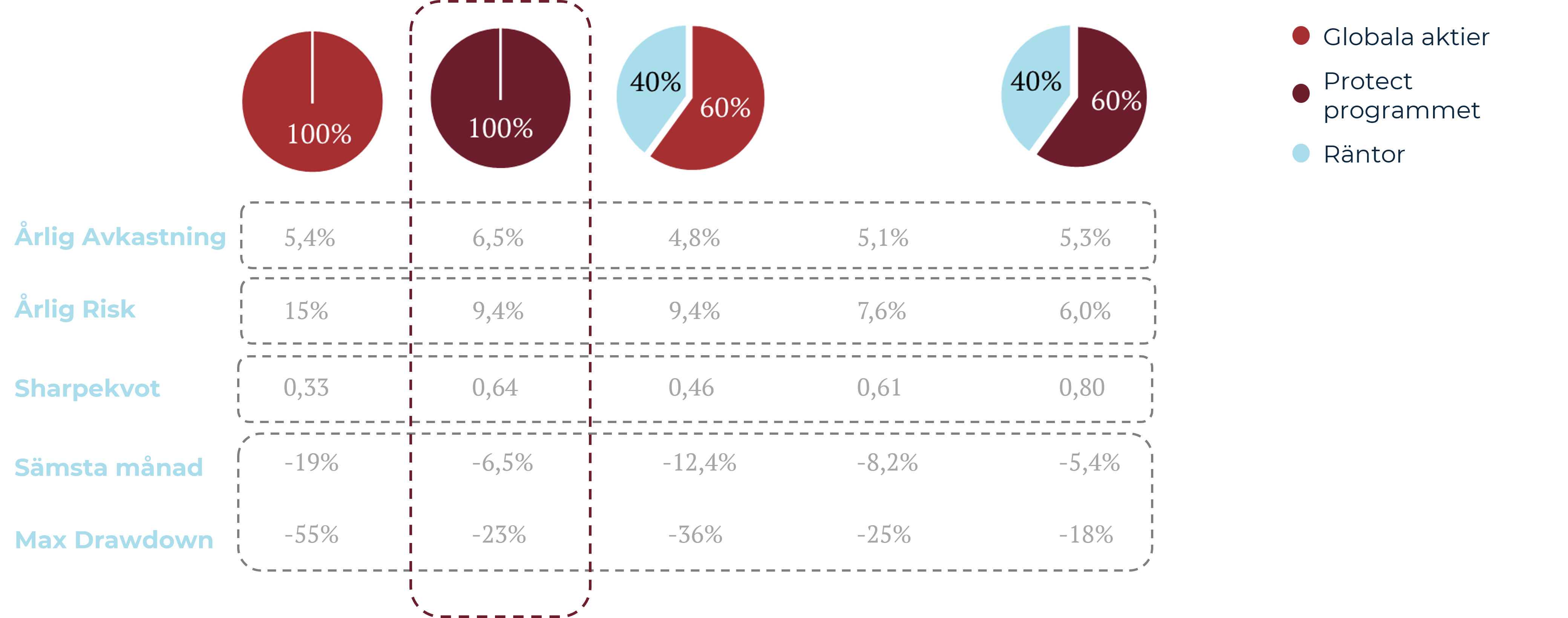

BiThe chart shows three investment strategies with different allocations between global equities, fixed income and Protect- the program. Protect- program is a strategy in which part of the portfolio is invested in Protect-fonden, which offers a protection mechanism against large stock market falls.

Crescit offers an innovative investment strategy with global equity exposure that combines equity market upside with robust downside protection, delivering strong risk-adjusted returns. The basis of the fund is interest management with low risk and short fixed interest rates.

By using options and other derivatives to actively manage market risk, the fund reduces volatility and avoids heavy losses, especially in turbulent market conditions such as during the Covid crisis 2020. The strategy is flexible and continuously adjusted to maximize returns while keeping risk low, making it ideal for investors seeking growth with protected capital.

Crescit focuses on liquidity management and short-term tactical trading, providing opportunities for higher returns in both up and down phases. The fund is an excellent choice for investors seeking a balance between stability and growth, with lower risk than traditional equity investments.

With a focus on capital preservation and risk-adjusted returns, offers Protect an efficient equity exposure with limited downside, ideal for investors seeking stable growth over time.

The fund is globally diversified and utilizes the stock market's positive long-term returns by systematically protecting against the market's biggest declines.

Through an ongoing portfolio protection strategy, the fund reduces the risk of suffering heavy losses, which was proven during the market crash in spring 2020 when the fund only fell by -8% while world indices fell with a full –34% during the same period. The fund sells the least likely upside in the short term to fund protection, providing a stable returnspot potential.

With a focus on capital preservation and risk-adjusted returns, offers Protect an efficient equity exposure with limited downside, ideal for investors seeking stable growth over time.

The fund is globally diversified and utilizes the stock market's positive long-term returns by systematically protecting against the market's biggest declines.

Through an ongoing portfolio protection strategy, the fund reduces the risk of suffering heavy losses, which was proven during the market crash in spring 2020 when the fund only fell by -8% while world indices fell with a full –34% during the same period. The fund sells the least likely upside in the short term to fund protection, providing a stable returnspot potential.

Sign up for our newsletter to receive our latest news