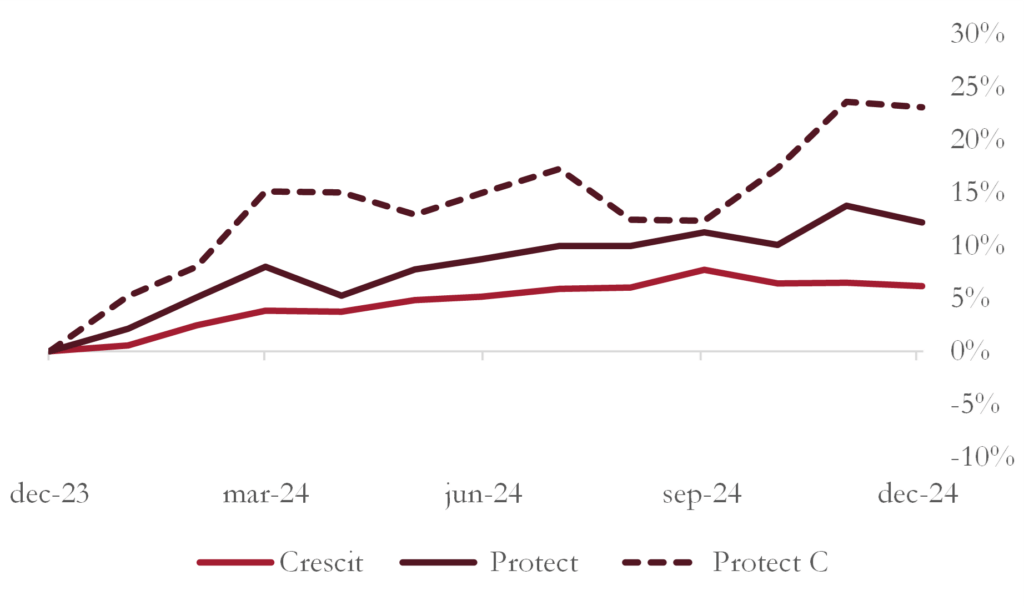

December was another divided month for the financial markets. European stock markets recovered somewhat while US stock markets retreated slightly after the strong rise around the presidential election. The year as a whole offered a very wide spread with US stock markets rising by more than +20% for the second year in a row while the European counterparts were listed for an average return of around 5 – 10%, with the Swedish OMXS30 behind the group with its mediocre +3.6% for 2024. Crescit's funds rose by 61% (Crescit hedge), +12.2% (Protect USD) and +23.11% (Protect C), see the return in the graph below.

Buying rumors and selling news

The fall was characterized by a relatively one-way market with the focus on Trump 2.0. The US stock market rose sharply with both the dollar and long-term interest rates in tandem. At the same time, the European market struggled under threats of trade wars and punitive tariffs. However, before the turn of the year, the trend has encountered a patrol in the form of hawkish rhetoric from the US Federal Reserve.

Hawks become doves become hawks again

This is not the first time in 2024 that the market's expected interest rate path from the Federal Reserve has been adjusted. The year has been unusually volatile in terms of expectations for central bank actions. At the beginning of the year, "everyone" was extremely confident that policy rates around the world would be lowered in a way that had previously only coincided with severe economic downturns. As inflation stubbornly remained at elevated levels, the interest rate cuts were moved further and further ahead, finally starting in the summer. From there, the cuts have continued steadily but at varying rates.

Europe in the election and qualifiers The Riksbank and the European Central Bank (ECB) have been cutting interest rates steadily and look set to continue into 2025. Against the backdrop of a stagnant economy and under threat of punitive tariffs, it is not unexpected that monetary policy needs to step up once again while bureaucrats and politicians continue to bicker with tireless energy. With new elections in Germany not due until February 23 and a rolling

Government crises in France and an inaction-paralyzed, albeit frequently investigating, government in Sweden look set to continue on the path they have chosen in 2025.