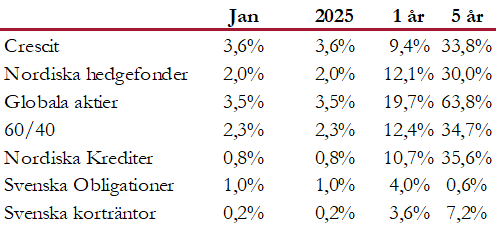

Crescit performed better than expected in January. Our short-term overweight to equities in general and Europe in particular was very beneficial. January's return of +3.64 % was the fund's 5th best ever and our best month since January 2023. It is no coincidence that January is a good month as there are clear seasonal patterns in both the equity market and the volatility market around Christmas and New Year.

The short-term bounce we saw ahead in Europe and Sweden materialized to a very high degree and contributed to the fund's strong performance. The fixed income book continued to perform well and we have increased our exposure slightly in anticipation of what we see as a better environment for Nordic credit as the economy picks up and interest rates fall.

January offered what so far appears to have been a classic technical and machine-driven buying situation. On Monday morning when Deepseek was announced, every stock and futures contract that could be sold was sold very aggressively. Why a cheap competitor to American-produced AI would be negative for Sweden and Europe was not entirely obvious, however, and in hindsight it turned out to have been a good buying situation in the turmoil that arose. The short-term profits we made have been realized at the time of writing.