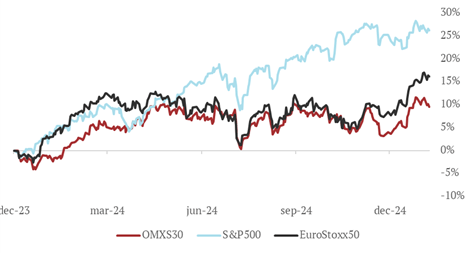

January was a strong month for Crescit, with a return of +3.64% in the main fund, the fifth best month ever. A tactical overweight to European stock markets, which have been relatively pressured, contributed to the success. Trump's rhetoric continues to affect the markets, and flows of money into US listed companies drove the S&P 500 up by 8% in the second half of 2024, while Swedish and European indices underperformed.

Investors began moving into European stocks in January, which were considered cheap compared to US stocks. Crescit has capitalized on this rotation, but the question is whether the development in Europe has gone too fast, as index levels have already reached forecasts for 2025. Interest rate paths are diverging, with expected cuts in Europe (around 2%) and stable rates in the US (around 4%).

Crescit is strengthening portfolio protections ahead of the spring, when protection prices are low and stock market optimism may be exaggerated. Europe continues to be in recession, but AI can offer hope for availability at lower prices. In Sweden, falling interest rates and wage increases are expected to increase household disposable income, which could benefit small and medium-sized companies.

Despite low volatility, Crescit sees opportunities in the bond market and is adjusting equity exposure downwards in favor of alternative return drivers. A larger rotation from the US to Europe is possible, but sentiment around tech companies like Nvidia is uncertain.

Developments in the American, European and Swedish stock markets over the past year