Crescit Protect manages each index separately. The aim is to minimize the so-called "basis risk". If there is a need to protect an underlying exposure, it is done specifically for that exposure and not via another market that is cheaper.

The starting point for Protect's exposure is the underlying stock market. The management does not take a position on individual companies in the index, but the entire market exposure is purchased via an index futures contract.

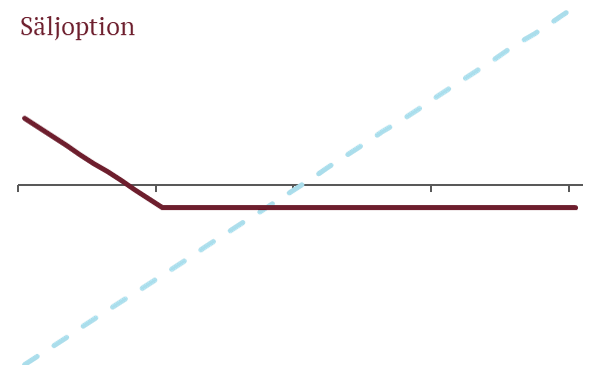

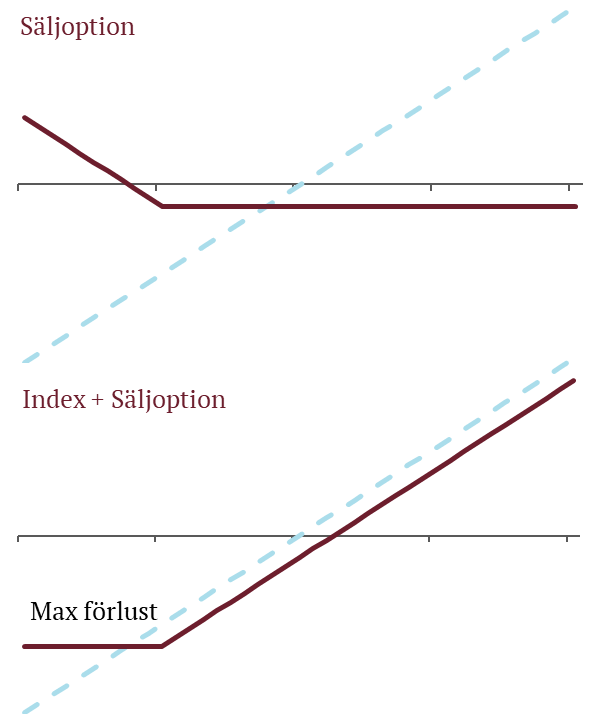

Protected underside

Protecting your stock portfolio with put options can be likened to taking out home insurance:

Advantages:

1. Protection against large losses: Just as home insurance protects against extensive damage, put options protect against sharp stock market declines.

2. Security: Knowing that you have protection can make it easier to maintain your investments during turbulent times.

3. Ability to profit from downturns: With protection in place, you can feel more secure when investing more during a falling market.

Cost:

The cost of the put options reduces your total return under normal market conditions, in the same way that insurance premiums reduce your disposable capital when nothing happens to your home.

Return profile:

1. Limited loss: Your maximum loss is limited to the index movement minus the strike price and option premium.

2. Slightly lower profit on an uptrend: The cost of the options reduces your return slightly in rising markets.

3. Smoother returns over time: Just as regular insurance premiums smooth out your expenses, option protection smooths out your portfolio's returns.

Benefit in relation to cost over time:

In the short term, the cost of protection may seem high, especially during long periods of upswing. But over the longer term, which includes both ups and downs, the benefits may outweigh the costs:

1. Reduced volatility: Your portfolio becomes less volatile, which can lead to better risk-adjusted returns over time.

2. Psychological advantage: You are less likely to panic sell during downturns, which can improve your long-term returns.

3. Better recovery: By limiting large declines, your portfolio has a better chance of recovering faster.

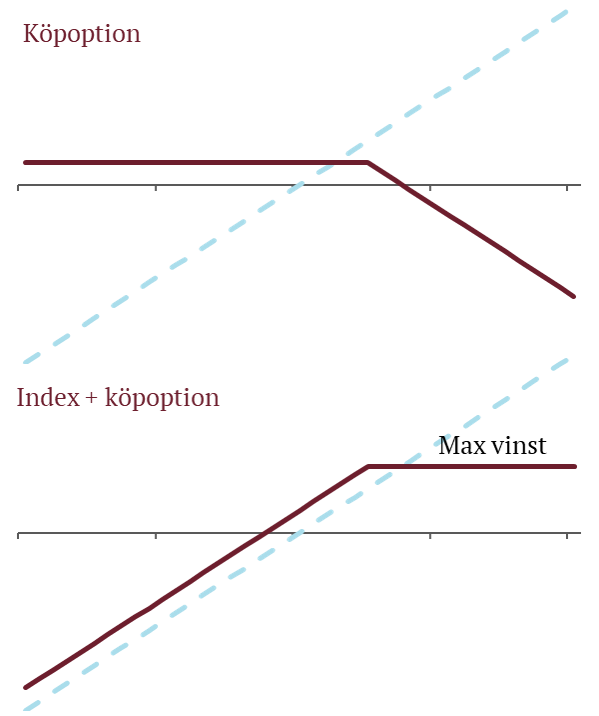

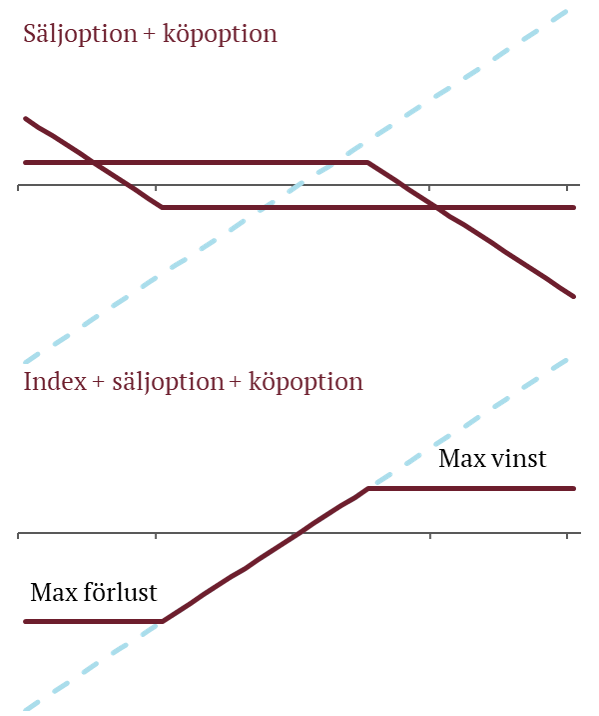

To balance the cost of the protection, a short-term profit limit can be sold. The fund gets the underlying exposure to a rising market via index futures, so call options can be sold against it and the premium received can balance the cost of the protection program. The level at which the call option becomes valuable is balanced between the historical probability that the option will make a profit and the premium that the option brings.

Overall, this provides a position with a softer decline and an opportunity for upside that is in line with most historical outcomes.

1. Effective risk control: Limits possible losses during market downturns.

2. Cost-effectiveness: The proceeds from sold call options can fully or partially finance the protection.

The options strategy provides a more controlled risk exposure to the stock market. This creates an opportunity to participate in market upswings while at the same time providing strong protection against significant downturns.

The management works consistently to manage the protection to balance the risk in the portfolio and optimize premium income.