It may be “a little” painful in the short term, but in the long term we will see growth like you have never seen before, he said. But no one believed him… The market movements that followed are not what anyone would have wanted, but they are movements that suit us well. The automatic portfolio protection we have in Crescit Protect is well adapted to an unstable environment.

Just a few (unusually long) days ago, Trump unveiled his list of “reciprocal” tariffs. A not-so-advanced mathematical formula formed the basis of what he presented as the solution to decades of injustice. The tariffs are intended to strengthen American manufacturing, labor, and competitiveness, while punishing nations that have long been parasitic on the American economy, thereby retroactively paying back the trade deficits that have “drained” the American economy.

Whether there is a method to the madness remains to be seen. What we can clearly see today is that no one seems to have believed him. War headlines are replacing each other and forecasters around the world are competing to write down their growth estimates as quickly as they can. As usual, the financial markets are reacting quickly and violently to the coming world upheaval. Global stock markets fell widely and are on track for their worst week since the COVID outbreak. Although the similarities stop there, we are somewhat surprised to see a president who actually seems to have learned from history. It appears that Trump believes he can slow down the economy in the short term to force lower interest rates and quantitative easing and then use fiscal stimulus to raise the economy like a phoenix rising to the sky on low interest rates and soaring stock prices.

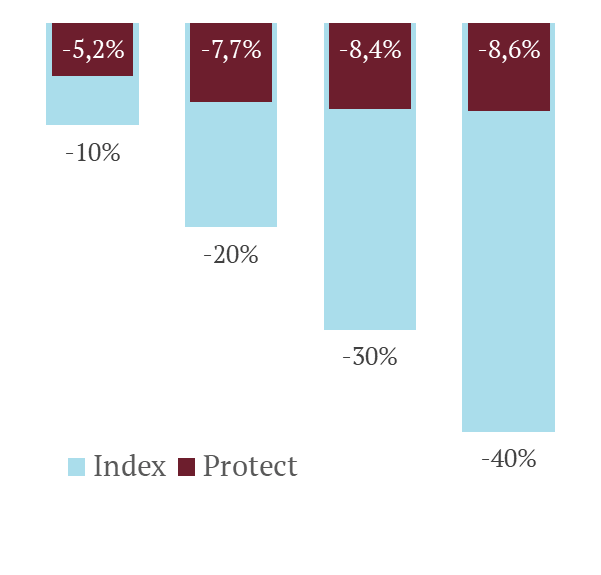

The financial markets have had an unusually turbulent week with large movements in all asset classes. Not least, the expected volatility is rising sharply as panic spreads through the investor community. The long-standing volatility has not yet reached crisis levels, but in the short term the risk is very high. It is a perfect storm for risky assets, and thus a perfect environment for Crescit Protect. Portfolio protections are doing exactly what they are supposed to do in an uncertain environment with rapid sharp stock market declines. The fund has had strong relative development during the year and in the first quarter the decline was limited to -1.7% at the same time as global stocks fell by -2.4%. By design, the fund is more sensitive in the initial stock market decline in order to then limit the loss in value in larger stock market declines, exactly what we are experiencing right now. Preliminarily, Protect has only lost -6.2% during the year at the same time as global stocks fell -10.6%. Should the stock market decline increase, the fund's exposure will quickly decrease. We have now reached the portfolio protection floor, which limits further loss of value. The fund is a defensive alternative to equity exposure or a safer alternative to mixed funds, which are normally based on assumptions about historical correlation between equities and interest rates, where Protect instead has automatic and fixed portfolio protection via put options.

The image below shows the fund's expected sensitivity as of March 31st. It clearly shows how the portfolio protections support the fund in major market declines. We now enter the potential part of the market crash where Protect creates its greatest possible benefit compared to traditional funds. Since the fund is fundamentally systematic, we still have the same exposure to the upside if the market were to reverse course. Stranger things have actually happened...