Market Letter January 2026

Protect delivered +1.05 % in January, while global equities rose around +1.6 %. The difference is explained by the fund's defensive profile and prioritization of downside protection over maximum

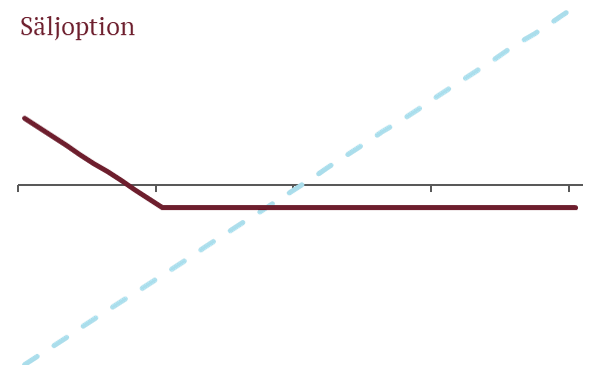

Crescit Protect is an innovative investment fund that offers global equity exposure with built-in protection against major downturns. The fund uses financial instruments such as options to create a protective structure around the fund's equity exposures, limiting losses during turbulent market periods. By combining exposure to four carefully selected equity indices from the US, Europe, Japan and the UK, the fund aims to mirror the global equity market. The fund's strategy has proven particularly valuable during turbulent periods, such as the Covid-19 pandemic, where it significantly limited losses compared to regular equity funds. The goal of Crescit Protect is to provide investors with the opportunity for good returns over time, while reducing the risk of large losses, making it an attractive choice for those who want to invest globally without having to worry about market timing.

Protect delivered +1.05 % in January, while global equities rose around +1.6 %. The difference is explained by the fund's defensive profile and prioritization of downside protection over maximum

The stock market year ended with relatively calm markets and falling concerns. US stocks barely moved at all in December, while volatility continued to decline. It sounds

Protect returned -0.46 % in a month where the fund's underlying index underperformed a broader global portfolio. During the autumn, we have strengthened the protection for the first half of 2026

Protect performed strongly during the month, mainly driven by strong stock market movements in both Europe and the US. The total return amounted to 2.6 %, which was an excess return compared to

| Year | January | Feb | Mar | April | May | June | Christmas | Aug | Sept | Oct | Nov | December | YTD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | 1.05% | 1.05% | |||||||||||

| 2025 | 2.30% | -0.31% | -3.6% | -0.59% | 2.9% | 2.41% | 1.15% | 1.56% | 2.67% | 2.64% | -0.46% | 0.4% | 11.44% |

| 2024 | 2.15% | 2.87% | 2.76% | -2.51% | 2.35% | 0.90% | 1.13% | 0.02% | 1.16% | -1.06% | 3.36% | -1.38% | 12.18% |

| 2023 | 4.57% | -1.07% | 1.80% | 1.65% | -0.58% | 3.88% | 1.57% | -2.32% | -3.39% | -2.46% | 4.51% | 2.29% | 10.46% |

| 2022 | -4.44% | -2.31% | 0.62% | -3.23% | -2.46% | -4.50% | 3.42% | -3.03% | -5.02% | 3.67% | 3.82% | -4.39% | -17.00% |

| 2021 | -0.06% | 2.68% | 2.46% | 3.23% | 0.57% | 0.96% | 1.61% | 2.18% | -3.26% | 3.77% | -0.64% | 3.30% | 17.91% |

| 2020 | -1.51% | -4.75% | 1.59% | 0.83% | 0.99% | 0.63% | 2.64% | 4.97% | -2.48% | -3.00% | 7.83% | 2.60% | 10.12% |

| 2019 | 1.48% | -4.92% | 4.32% | 1.03% | -3.01% | 1.14% | 0.25% | 2.50% | 2.62% | 5.20% |

Crescit Protect offers a unique investment strategy that combines global equity exposure with sophisticated risk management. Below is a detailed review of the fund's central elements and how they

Protect is an innovative global equity fund that offers investors exposure to the global equity market with a unique risk management strategy. Unlike traditional global equity funds, which invest directly

Protect continues to weather market turbulence well, losing only -0.59% in April. The protection program provides good protection when the stock market falls and volatility rises. Since

August was an unexpectedly strong month for the stock market. After the strong recovery from the spring stock market decline, many suspected that late summer could be weak. But instead, the

July was a strong month for financial markets. Stock indices rose broadly all the way to the penultimate day of the month. At the same time, long-term interest rates remained

June was a volatile month for the stock market. After a weak start, risk appetite recovered, causing US stocks in particular to rise sharply. This puts us

May was a very strong month for the world's financial markets. After two months of turmoil, both equity and credit markets recovered broadly. Crescit's funds

Crescit Protect manages each index separately. The aim is to minimize the so-called "base risk". If there is a need to hedge an underlying exposure

A legal person is an organization or entity that, like a natural person, has the legal capacity to enter into contracts, own assets and have obligations under law. Examples of legal entities include limited liability companies, economic associations, foundations, condominium associations and municipalities, all of which have their own legal identity separate from the individuals who make up or manage them.

A natural person is an individual with legal capacity. Unlike legal entities, such as companies and organizations, a natural person represents himself in legal contexts. Natural persons have the ability to enter into contracts, own property and pay taxes, making them active participants in society's economic and legal system.

You can find complete information about Crescit's funds in the funds' fact sheets and information brochures. You will also find other documents here, including full and half-year reports. The material on these pages is intended as general product information only. It should not be seen as investment advice or investment recommendations and should not be used as a basis for investment decisions. You should always read the fund's fact sheet and information brochure/prospectus before you start saving in a fund. We cannot guarantee that the information is complete and it is subject to change without notice. The published share value (NAV rate) is based on the latest available data.

We use device identifiers to personalize content for users, provide social media features, and analyze our traffic. We also forward such identifiers and other information from your device to the social media and advertising and analytics companies we partner with. They may, in turn, combine the information with other information you have provided or that they have collected when you have used their services. You agree to our cookies by continuing to use our website.

Sign up for our newsletter to receive our latest news