years of combined experience

years of combined experience

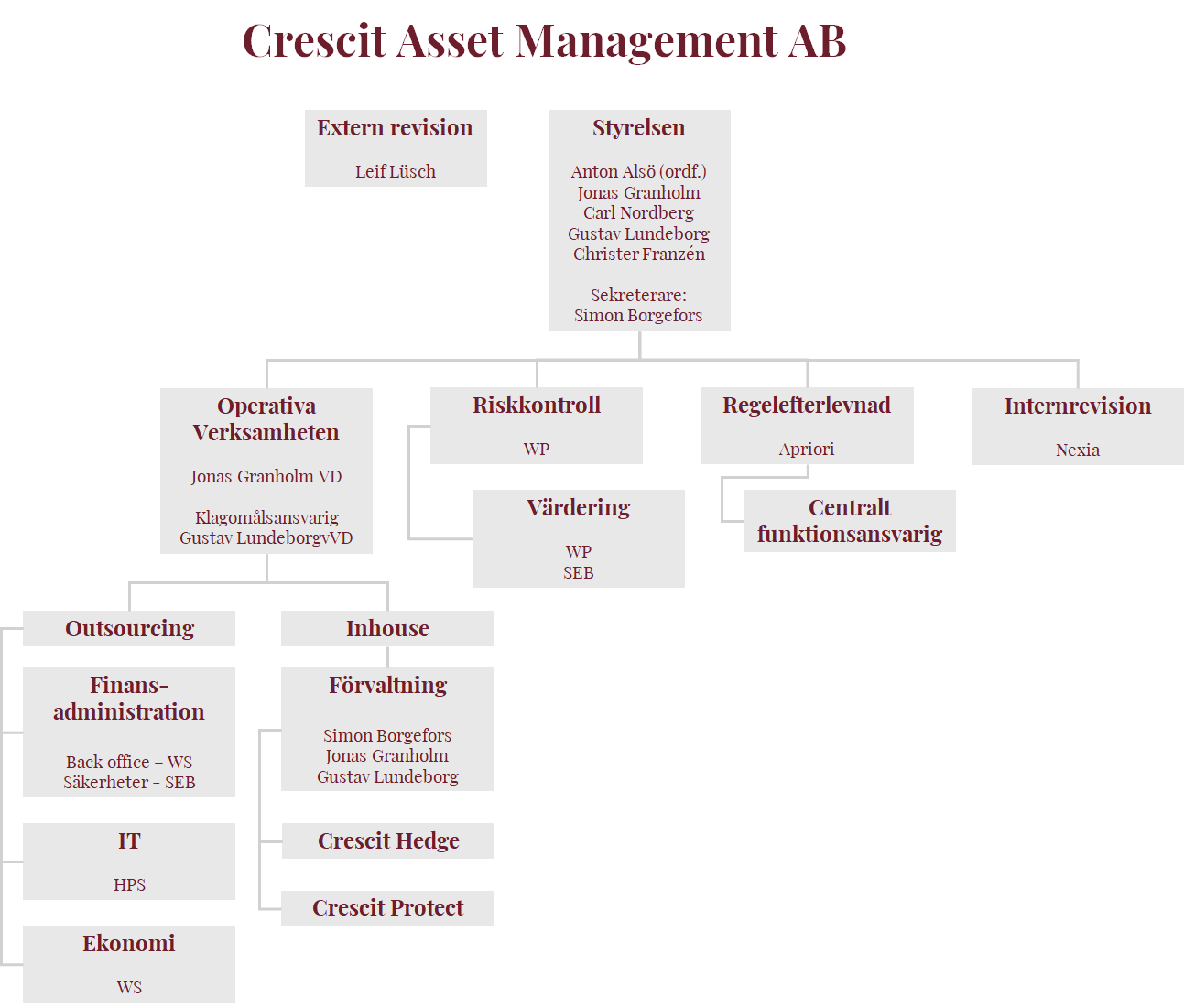

Crescit's organization is designed to create value for our investors through strong teams, clear processes and a rigorous control environment. With the management team at the center, we ensure that every investment decision is based on in-depth expertise and careful analysis, providing a safe and efficient investment process.

We have built a structure that combines the industry's best skills. Our management team works closely with our independent risk control functions to ensure that all investment decisions not only maximize potential, but also meet our high standards of risk management and compliance.

By handpicking a board of experienced industry experts, Crescit has created a culture that places high demands on ourselves and our partners. The board provides valuable guidance and continuously reviews operations to maintain the highest standards in both management and risk control.

With a clear division between management and control functions, we can minimize risk and optimize performance, giving our investors both security and predictability. Crescit's organization is designed to deliver stability and quality, regardless of market conditions. By collaborating with leading players, Crescit creates an optimized organization that can focus fully on management and investment decisions.

Jonas Granholm is CEO of Crescit. Jonas is responsible for the management of the funds. Previously, he functioned as globally responsible for the administration of all of the Skanska Group's pension foundations. Long experience from board work in various companies and foundations abroad as well as in Sweden, risk control, analysis and manager of Skanska's Swedish pension foundations. Advanced studies in financial economics at the Stockholm School of Economics and Rensselaer Polytechnic Institute, USA. Master of Economics from the Swedish School of Economics in Finland.

Simon Borgefors is responsible for trading, portfolio management and analysis work. Simon has many years of experience in asset management and options trading and has worked for Crescit since 2018. Simon has a master's degree in engineering from the Royal Institute of Technology and contributes valuable analytical and technical skills to the company's operations. Simon also serves as secretary to the board.

Gustav Lundeborg is deputy managing director of Crescit. Gustav is responsible for the management of the funds. Previously, Gustav served as trustee of the Skanska Group's Swedish pension foundation. Gustav has also been an interest rate and currency trader at Skanska for several years. Gustav has a master's degree in economics from Uppsala University.

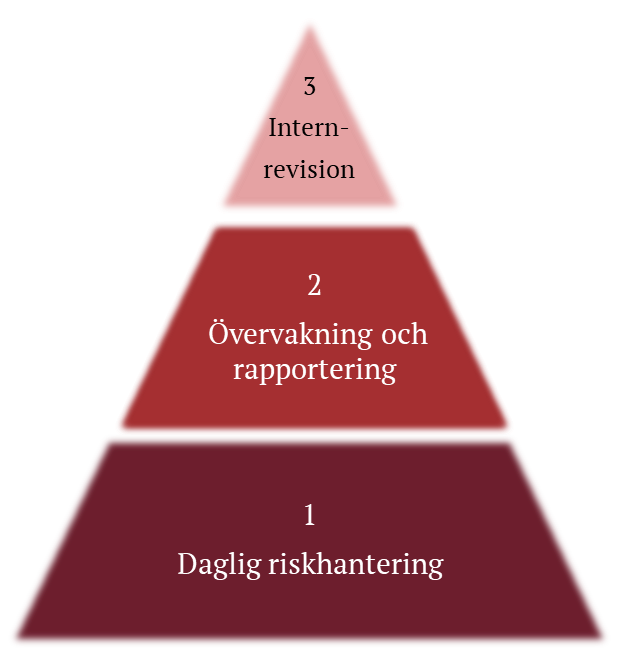

Crescit organizes its risk management according to a three-pronged line of defense to ensure that risks are managed effectively and that operations are conducted in accordance with internal policies and external regulations.

First line of defense – Operational risk management: The first line consists of the daily operations, which are responsible for identifying, managing and minimizing risks in the ongoing work. This includes both internal processes and external partners, such as Wahlstedt and Sageryd AB (WS) and SEB, which support the business in balancing risk and return within the framework of Crescit strategy.

Second line of defense – Independent monitoring and control: The second line has a controlling and monitoring role for the entire operation, including the funds. It consists of an independent Risk function and Regulatory compliance function, which ensures that risk management within the first line is conducted correctly and in accordance with current regulations. The risk function monitors and analyzes the company's total risk exposure and ensures that strategies and processes for risk management are followed. The regulatory compliance function checks that the business lives up to internal policies and external regulatory requirements. Both functions report directly to the board, which creates transparency and accountability.

Third line of defense – Internal audit: The third line consists of an independent internal audit function. Internal audit reviews and evaluates the work of both the first and second lines of defense to ensure that risk management processes, rules and guidelines are followed and effective. This function contributes to strengthening the organisation's resilience and long-term sustainability

The board has appointed Wahlstedt and Sageryd AB (WS) as responsible for the fund's administration. All portfolio transactions executed or placed by Crescit are compiled and reported by WS.

In connection with a portfolio transaction being carried out or placed by Crescit, the counterparty must send the business document (bill) to WS electronically. In connection with this, Crescit must register the transaction in a WEB client and WS thereby immediately becomes aware of the transaction. WS then "matches" the business documents from the counterparty with the registration in the WEB client carried out by Crescit. WS must notify Crescit of any discrepancies between the business documents and Crescit's registration. WS also checks that any brokerage amounts are consistent with any agreements with the counterparty. WS must instruct the custodian to settle the portfolio transaction.

Wahlstedt Sageryd provides back office services and additional services in finance and accounting for fund companies and institutional asset managers. The outsourcing was born 20 years ago in close cooperation with the customer and has grown ever since. WS Backoffice administers client portfolios with precision and accuracy and has zero tolerance for errors as key words. Together with the WS CRM group and with W&P's ambitious financial experts, as well as in close cooperation with the law firm Nihlmark & Zacharoff, the highest possible customer service is delivered.

For the Crescit fund, SEB Risk and valuation services is responsible for the daily valuation and risk calculation used for all limit calculations. SEB is responsible for the calculation of the monthly NAV calculation.

For Protect, Wahlstedt & Partners has the same area of responsibility.

The board has appointed SEB Risk and valuation services as risk and valuation manager for the Crescit fund. Independent of management, risks, exposures, liquidity, stress tests and valuations are calculated. SEB receives position documents from the administration and performs daily calculations and monthly, in connection with the NAV, the official valuation as the basis for the fund's trading rates.

For the Protect fund, the board has chosen to appoint Wahlstedt & Partners (WP) as external valuers. The valuation unit within WP works closely with both risk control and administration and shares position systems for real-time updates.

The risk function is responsible for ensuring that management does not contravene the restrictions stipulated by the funds' limits. Both the external and internal limits are checked daily. regarding VaR or stress tests that have been established in fund regulations as well as in the internal limits established by the board or CEO and that any violations are rectified as soon as possible and in the interest of the unit owners. The risk function is also responsible for reviewing the valuation of the derivatives as well as calculations of VaR and stress tests to ensure the quality of the reports.

For a more in-depth description of the risk function's responsibilities and tasks, systems, identification, follow-up and control, it is important that investors take note of the information in the fund's risk instruction, which can be obtained from the company.

Wahlstedt & Partners AB (W&P), under the supervision of the Financial Supervisory Authority since 2014, is responsible for risk management with Tobias Färnlycke as responsible for Crescitskonto. The function works independently of portfolio management and ensures that the fund company can monitor and assess risks in accordance with the law and fund regulations.

Marie has previously worked at SEB as an asset manager, private banks and trader. Marie also has a background as CEO of a fund company and a securities company based in Luxembourg. Marie became a member of the bar association in 2011.

The regulatory compliance function is directly subordinate to the Board and independent of Crescit's operational activities. The compliance function is a permanent part of Crescit's organization.

The board has appointed Advokatfirman Apriori ("Apriori") with attorney Marie Friman as responsible for the Regulatory Compliance function. Crescit and Apriori have entered into an assignment agreement that regulates the scope of the assignment and responsibilities.

The compliance function's main responsibilities are customer protection, market conduct, prevention of money laundering and terrorist financing, and licensing and regulatory issues. Taking into account the areas of responsibility, the Regulatory Compliance function must fulfill a large number of tasks in Crescit's operations.

If necessary, the compliance function must also cooperate and coordinate its work with the Risk function and the Internal Audit function.

For a detailed description of the regulatory compliance function's responsibilities and tasks, a potential investor can take advantage of the information in the fund's regulatory compliance instruction, which can be obtained from the company

The internal audit function is directly subordinate to the Board and independent of Crescit's operational activities. The internal audit function is a permanent part of Crescit's organization.

The board has appointed Nexia Revision Stockholm AB ("Nexia") with Anders Fornstedt as Internal Auditor. Crescit and Nexia have entered into an assignment agreement that regulates the scope of the assignment and responsibilities. In cases where the Internal Audit function cannot fulfill its mission due to lack of competence or lack of competence in the auditing area, external resources must be procured to assist the Internal Audit function in its audit task.

The internal audit function's activities must, if necessary, be coordinated with audit assignments carried out by external auditors. Crescit's external auditors are responsible for reviewing annual reports (including financial reporting) and related documents.

Crescit's internal audit function shall, based on the audit plan established by the Board, examine and assess whether Crescit's systems, internal control mechanisms and routines are appropriate and effective. Furthermore, the internal audit must issue recommendations on the basis of the work carried out and check that these recommendations are followed, as well as report on internal audit issues to the Board and CEO.

The internal audit function must check that any remarks and recommendations from external auditors are addressed and followed up. The internal audit function must also, if necessary, participate in meetings with Crescit's external auditors.

For a detailed description of the internal audit's areas of responsibility and duties, a potential investor can take advantage of the information in the fund's instructions for internal auditing available from the fund company.

Nexia Revision in Stockholm belongs to Nexia International, which is an international network of local audit and consulting agencies. Nexia Revision Stockholm was founded in 1997 and today we are top 15 on the list of the largest audit organizations in the world. In addition to solid competence, we offer our customers high quality, availability, the best possible service and a great deal of personal commitment. In Stockholm, we have about thirty employees and now we are going to have more.

IT security and cloud services are managed by High performance systems.

Reconciliation and transfer of collateral for derivatives trading is handled by SEB Collateral management

Bookkeeping, administration and payments for the fund company are handled by Wahlstedt & Sageryd

Anton Alsö has been on Crescit's board since autumn 2024. Anton is a senior portfolio manager at Mandatum Asset Management and is responsible for managing Nordic high-yield bonds. Anton has extensive experience in asset management but also from investment banking, where he has worked mainly with advice in restructuring. Anton is educated at Växjö University and has co-authored the book Regulatory issues on the Swedish corporate bond market.

Jonas Granholm is CEO of Crescit. Jonas is responsible for the fund's management. Previously, he functioned as globally responsible for the administration of all of the Skanska Group's pension foundations. Long experience from board work in various companies and foundations abroad as well as in Sweden, risk control, analysis and manager of Skanska's Swedish pension foundations. Advanced studies in financial economics at the Stockholm School of Economics and Rensselaer Polytechnic Institute, USA. Master of Economics from the Swedish School of Economics in Finland.

Christer Franzén has been a member of the board of Crescit since 2013. He is also the contact person on the board in relation to the risk function and is responsible for conflicts of interest. Christer is CEO at Ericsson Pension Foundation. Christer has a long and solid experience in portfolio management. Graduated in Economics from Örebro University and financial studies at Southern Methodist University - Cox School of Business.

Gustav Lundeborg is deputy managing director of Crescit. Gustav is responsible for the fund's management. Previously, Gustav served as trustee of the Skanska Group's Swedish pension foundation. Gustav has also been an interest rate and currency trader at Skanska for several years. Gustav has a master's degree in economics from Uppsala University.

Carl Nordberg is a board member of Crescit Asset Management AB and he is also the contact person on the board in relation to the regulatory compliance function. For over a decade, Carl has worked as a portfolio manager at Postens Pensionstiftelse with a focus on hedge funds and currency. Carl previously worked at Länsförsäkringar Bank and before that at Nordea Securities. Carl has a master's degree in economics from Stockholm University.

The material on these pages is intended as general product information only. It should not be seen as investment advice or investment recommendations and should not be used as a basis for investment decisions. You should always read the fund's fact sheet and information brochure/prospectus before you start saving in a fund. We cannot guarantee that the information is complete and it is subject to change without notice. The published share value (NAV rate) is based on the latest available data.

Sign up for our newsletter to receive our latest news